Looking Forward to 2023: Slow and Steady Wins the Race

[Editor’s Note: Below is the full text of our 238th Weekly Transmission, originally delivered direct to the inbox of more than 600 GEM Diamond members on January 4th, 2023.

Please note that some links are GEM Diamond Exclusives]

For two straight years our central prediction theme was climate (2021 version). The importance of climate hasn’t lessened in 2023. In fact, the impact of the Inflation Reduction Act will reverberate for years to come.

That said, we’re going back to the basics in 2023: profits rule and negative unit economics drool.

When capital was nearly free for corporations, products and services not feasible in normal environments became feasible. Well, the music has stopped and the chickens have come home to roost. Unprofitable companies can no longer hide behind a “grow at all costs” directorate.

Bryan Copley is a firm believer the tortoise will be sexier than the hare this year:

The Fed will continue to grind the gears of economic growth, and the cheap capital financing meteoric startup growth for companies without a plausible path to profitability has dried up faster than the Los Angeles River. The age of cheap growth is a bygone age; growth in 2023 and beyond will be earned, not bought.

Imagine startups are race cars and interest rates are gas prices. When gas is cheap and it’s a drag race to the SPAC that takes you public, acceleration is all that matters. Now that gas is expensive and the finish line further away, acceleration takes a back seat to gas mileage. For the first time in a long time, the tortoise is sexier than the hare.

Startups shouldn’t optimize to meet Warren Buffet’s standards for company profitability. Buffett invests mostly in de-risked, low alpha companies with mature, stabilized cash flows. VCs comb the earth for high alpha opportunities where they can take calculated, concentrated risks on companies with asymmetric upside potential.

Today, as in the bygone age of cheap growth, startups and investors alike will continue to take and embrace risk. Like KPCB cofounder Tom Perkins said:

‘If there is no risk, you have already missed the boat.’

But in 2023, look for startups to begin architecting slower, steadier, more sustainable growth models that yield more capital-efficiency—perhaps even profits!—prior to an IPO.

The return of business pragmatism. Fighting tooth and nail to put every dollar in the bank, day after day, month after month. 2023 will be a year that perseverance, grit, and belly-to-belly combat on the business battlefield wins.

-DM

Below, GEM members share a range of interesting trends and predictions for 2023.

PROPTECH TRENDS

GENERATIVE AI ONSLAUGHT

Drew Meyers // Founder, Geek Estate

My services are no longer required. Let’s put GEM on autopilot and we can all learn from the bots.

In all seriousness, the ramifications of what’s coming from OpenAI’s ChatGPT and others are beyond immense. The speed of progress with this technology is like nothing we’ve ever seen. Likening it to a locomotive with no brakes would be an understatement.

Writing listing descriptions will become an art of the past. Conversational customer service and sales bots will actually become tolerable. Perhaps, dare I say, interesting. Social media content writers and graphic designers will be in search of new revenue streams. Home buyers will be provided a personal assistant that talks their language, and has access to their financial and home browsing data.

Some say video will avoid extinction the way other content will not. But, if Morgan Freeman’s deepfake and Val Kilmer’s convincing AI voice are any indication, we’re in trouble:

Endless ethical questions arise when there are few, if any, lines between real and fake. We’ll constantly debate the implications of synthetic reality, and we will both blur and grossly cross many lines that once defined reality and work up until now.

On the plus side, the value of thoughtful curation and expert analysis will increase in value as the internet turns into a cesspool of auto-created, time-wasting marketing copy.

POWER OF THE MACHINES

Dave Garland // Partner, Second Century Ventures

We are in the midst of one of the most profound cultural evolutions in human history. Breakthrough technology in robotics and AI, powered by algorithms and mounting data sets, will elevate humanity to new heights. 2023 will be a BIG year for machine-based enhancements. What does this mean for real estate? We can expect a tale of juxtapositions:

- Peak AI?: We will see GPT4 in the spring. Combined with incredible new generative AI applications in text, image, and video, human creativity will be challenged to expand its horizons by computer-based creativity. But real estate practitioners will not likely adopt this new tech en masse. Rather, we can expect to see improvements within existing systems (i.e. transaction management, CRM, B2C advertising) that leverage AI for incremental cost savings in a period where transactions are in decline YoY. (Look to companies like Notarize, Plunk, and Evocalize for clues.)

- Intersectionality: Growing data sets will yield more decision engines to automate complex tasks across industries and segments. For real estate, this means emerging technologies can better integrate brokerage with lending, title, insurance, and all settlement services for a more streamlined, digitized customer experience (ideally at a lower cost). (Look to companies like CRETelligent, Transactly, HouseCanary and Obie to lead the way here)

- Affordability: The three killer ‘i’s of 2022 (interest rates, inflation, and inventory constraints) will put a heightened focus on affordability in 2023 as consumers around the globe are presented with a growing cadre of financial products to extract more equity from an existing asset, or help procure an asset in a period of growing credit constraints. Look for more down payment assistance, equity release, fractionalization, and private equity placements to collide with traditional bank-based underwriting models in effort to help address this growing global concern. (Look to companies like Landis, Fractional, Matrix, and FutureRent for leadership in this space.)

NEW FORMS OF OWNERSHIP DEMONSTRATE MOMENTUM

David Bluhm // Co-founder, Plunk

Companies like Arrived, Fractional, Here, Flock Homes, and Rook Capital light new paths towards becoming a real estate investor for as little as $10 and 10 minutes. The ability to become a rental property owner without the traditional hurdles of time and money is a game changer toward making real estate ownership more accessible to everyone. The ownership revolution is the future, and the pace is accelerating.

OPENDOOR OPENS THE DOOR TO A NEW NATIONAL MLS

Robert Hahn // Partner, 7DS Associates

Opendoor launched its Opendoor Exclusives marketplace, which allows sellers to connect directly with buyers in several markets without the use of traditional real estate agents. Part of the company’s 3P Platform, the marketplace includes an e-commerce experience for buying an Opendoor-owned home.

Opendoor is outright telling everybody that it intends to get rid of both real estate agents and “traditional listings.” No MLS or REALTOR Association can let that stand. Plus, under the rules today, Opendoor Exclusives—whether 1P or 3P—end up on Zillow’s second tab.

That means Opendoor will be forced into becoming an MLS, more or less. It won’t actually be an MLS in the traditional sense, just like the Customer-Owned Exclusive is not a “listing” in the traditional sense. It’s not as if agents can enter listings into the Opendoor 3P Marketplace and get credit, cooperation, or compensation. But it will be an MLS for the purpose of getting Opendoor properties onto Zillow, Homes.com, and other portals. Longer version on Notorious ROB.

ADOPTION OF SUSTAINABILITY PRACTICES

Jonathan Klein // Founder, GoProptech

With the global emphasis on strengthening ESG principles for growth and operations, the real estate technology industry will accelerate the integration of sustainability practices in 2023. Due to reliance on the efficiency of materials, energy, time, and money, sustainability is not limited to the environment. Advanced 3D technologies—including BIM, real-time 3D visualization, 3D printing, 3D renderings, and AR/VR—will enable the design, creation, prefabrication, and photorealistic representation of sustainable and green 3D models. Digital twins will further contribute to building resilience, fostering decarbonization, optimizing work environments, and enhancing every decision-making phase, from concept, design, and construction through to operation. Beyond the environmental benefits, real-time visualization technology will attract a new generation of architects and designers, who will create enticing buildings for investors, buyers, leaseholders, and stakeholders. 3D visualization may very well be the remedy tonic for a sagging 2023 real estate market.

A BOON FOR FLAGSHIP TRAVEL DESTINATIONS

Wes Walker // CEO & Co-founder, Propersum

The current Effective Federal Funds Rate (EFFR) upward march, combined with increased media attention on household finances, will result in general travel accommodations traffic funneling heavier to legacy, flagship destination markets ( the Outer Banks, Orlando, Napa, Vail, Tahoe, Ozarks, NOLA, etc.) where consumers feel less “experience risk”. Notable negative impacts will occur in secondary travel markets (i.e., Airbnb markets) with extreme impacts on tertiary areas ( “middle-of-nowhere” Airbnbs). Both secondary travel markets and tertiary areas were artificially pumped from COVID lockdown escapism and the expansion of remote work adoption, and both will experience market corrections in 2023. Luxury real estate, although typically most impacted by EFFR and Quantitative Tightening compared with standard homes, will manage fairly well in legacy, flagship destination markets as traveler density, and therefore supporting rental income, cycles back from secondary markets and tertiary areas.

HOMERENTERSHIP REALITY SHOWS

Vin Vomero // Co-founder, FoxyAI

The erosion of the single greatest driver of wealth for Americans—homeownership—should be a major concern for everyone. Wealth growth from a home is largely attributed to home value appreciation and not from making mortgage payments to pay down the balance.

What happens when this piggy bank no longer exists? What happens when this wealth is diverted to—and more concentrated on—Wall Street due to a growing trend in Single Family Rentals (SFR) and the emerging build-to-rent trend?

There are many macro factors to consider in the movement away from homeownership to “homerentership,” and 2023 is poised to be a difficult year for home buying with the continued growth of interest rates, low supply, and rising inflation.

VENTURE COOLDOWN IN EFFECT

Kunal Lunawat // Partner, Agya Ventures

We are moving away from an era where capital was plenty and diligence was absent. Total capital deployed in venture was $300 billion in 2020, $630 billion in 2021, and is projected to be $439 billion in 2022. The 2023 numbers might reflect a greater reversion to the mean mapping to the pre-pandemic era. That’s a good thing for serious entrepreneurs and career venture capital investors.

Higher cost of capital and a sharp pullback in high-growth technology stocks have distinctly impacted valuations of privately held, late-stage technology companies. The birth of unicorns is one metric to gauge hype surrounding late-stage valuations. There are 1,192 unicorns in the world today: 136 were born in Q3 ‘21. The number declined to 25 in Q3 ‘22. This could partially be attributed to smaller round sizes, but the bigger picture is clear: companies need to earn their markups.

Sarah Liu // Partner, Fifth Wall

2023 will see significant consolidation across proptech start-ups as many of the companies that were able to raise during the glut of 2021, will find far fewer takers when they go back out to market. Sectors that were especially saturated such as construction site monitoring and sensor tech, as well as sectors that are seeing an outsized impact from higher interest rates (i.e., mortgage and residential closing), will be the hardest hit. Those that survive will be the ones who generate the strongest measurable customer ROI, ideally in a short (i.e., months not years) time frame.

CLOSING THE SPIGOT OF HOME EQUITY TAPPING

Matt Michalski // Co-founder, Aryeo

Now that capital is no longer free and real estate markets are no longer full of huge equity gains, startups helping homeowners tap into their home equity will see a major cooling-off period. The number of options available in the market will decrease substantially, but no one dominant force will emerge victorious.

STR NUCLEAR WINTER BEGINS

Brad Hargreaves // Founder & Chairman, Common

Oversupply and demand contraction are combining to make 2023 a very, very difficult year for the short-term rental business.

First, let’s start on the supply side. Airbnb listings are up 23% year-over-year with over 80,000 new listings coming on to Airbnb per month this past summer. Compounding the problem, a large portion of the new supply is investor-owned, dedicated short-term rental properties with lots of availability. The supply problem is likely to get worse over the coming year, as would-be home sellers with existing, low-rate mortgages choose to rent their homes out rather than sell into a tough market.

Things do not look better on the demand side of the equation. To begin, hospitality occupancy is very sensitive to macroeconomic conditions, and hotel industry insiders are forecasting declines in occupancy and ADR in 2023 in anticipation of a “mild” recession. It is also likely that 2021 and early 2022’s extraordinary run in STR revenues was partly driven by pandemic-era spending and behaviors that aren’t likely to continue.

Qualitatively, by early 2022 the short-term rental sector was getting get-rich-quick vibes as retail investors increasingly gained interest in the space. Articles targeting retired doctors and claiming 20%+ cash-on-cash yields is as close to a universal indicator of a peak as they get. There was also a growing cottage industry of picks-and-shovels businesses helping others buy and manage STR properties, with enough courses on getting rich in short-term rentals that we got lists and aggregators of courses on getting rich in short-term rentals.

No offense to plastic surgeons with a genuine hobbyist interest in hospitality, but a lot of this kind of content popped up on the internet in 2022.

In light of all this, a pullback seems inevitable and will hit publicly-listed companies (e.g., Sonder), privately-held firms (e.g., AvantStay) and retail investors all.

Expanding Multigenerational Living through ADUs

Brad Cartier // Head of Marketing, Hostfully

271%. That’s the increase in people living in a multigenerational household between 2011 and 2021. Further, Freddie Mac found that the share of young borrowers with a co-borrower age 55+ has doubled since 1994, spiking in 2021.

Zillow recently found that 18% of recent homebuyers purchased alongside a friend or relative, and 19% of prospective buyers planned to do the same.

The pandemic accelerated the adoption of multigenerational living arrangements: Caregiving is cited as the second most popular reason for multigenerational living, particularly in Hispanic, Asian, and Black households.

With 39% of buyers preferring a home “designed to house the buyer as well as a younger generation and an older generation,” many builders are taking notice by offering floor plans geared towards accommodating multiple generations. Lennar, for instance, offers new homes with self-contained in-law suites.

The benefits of multigenerational living are undeniable: shared budgets, caregiver access, socialization and quality time together, and dedicated space for everyone.That said, most of our housing stock isn’t designed for this eventuality. The year ahead marks an opportunity for real estate entrepreneurs to get ahead of this (re)emerging trend by building and renovating with grandma and grandpa in mind.

LETS (QUICKLY) CLOSE THE DEAL

Teresa Grobecker // CEO, Consortia

Lenders want to close escrow in 10 days or less. Why, you ask? As I always say on stage: follow the money. The cost of underwriting a loan has ballooned to over $11,000 and lenders are averaging losses of $800 per file.

The largest banks and lenders are adopting processes to stop the bleeding.

Given Consortia works with the GSEs (Fannie/Freddie), the Federal Reserve and the largest banks, credit unions and lenders in the country, we have a few confident expectations:

- Title: In San Francisco, we waive our title contingencies. Are we crazy and off our rockers? (Yes, but for different reasons.) Clear chain of title can’t be rushed, hence why preliminary title commitments are done before listings go on the MLS. We are able to close in seven days because we underwrite the asset before going on the MLS. The largest banks are agreeing to this process to close loans faster.

- Appraisal: A handful of the best lenders know that Fannie and Freddie are moving toward a 100% data driven appraisal system. (NAR even has a portfolio company that helps REALTORS gather this information as a gig-economy job alternative.) This data will be used for appraisal waivers and hybrid appraisals, shaving off weeks of the appraisal contingency timeline.

- And last but not least, money: The Federal Reserve will be ready to settle transactions instantly 24/7/365 starting May 2023. The most reputable banks in the country with the highest SOC2 audit protocols are part of the rollout. Combine this with the new digital fiat currencies that the major G20 economies are rolling out (the “digital dollar,” as it’s known in the United States), and the United States will have the fastest, most secure real estate purchase money transfer system in the world.

Brokers who adopt these practices will have the competitive advantage to win more listings and close transactions faster. As we say at Consortia, slow is smooth, and smooth becomes fast.

PREDICTIONS

ROCKET MORTGAGE ACQUIRES REDFIN

Robert Hahn // Partner, 7DS Associates

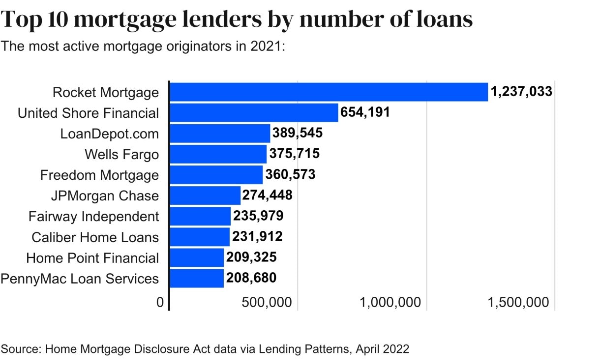

With Rocket Companies having an advantage in the mortgage space but at a disadvantage in the home buying and selling space compared to Zillow, acquiring Redfin would be a way to one-up Zillow.

Rocket Companies is a $16 billion company right now. Zillow is about $8.5 billion. Redfin has fallen from grace and sits at $536 million. Rocket could buy Redfin for cash today; Redfin shareholders would likely be interested in a stock swap as well if that were offered. Redfin would give Rocket Homes an instant presence as a real estate portal. Plus, Rocket Mortgage could move Redfin’s W2 workforce to Rocket Homes to serve as in-house agents without too much difficulty. There is at least one very good reason for doing that: A W2 employee agent can (as per Glenn Kelman) sell every product the company has, including mortgage, without running afoul of RESPA. Zillow can’t do that with its Premier Agent network. Originally published on Notorious ROB.

ZUMPBNB

Matt Michalski // Co-founder, Aryeo

The Airbnb <> Zillow merger has long been talked about. But proptech’s leader will make a splash with another Z: Zumper.

Zillbnb meet Zumpbnb.

Airbnb began with short-term stays and has since evolved into stays of any length—just short of “permanent.” Meanwhile, Zumper has emerged as a leader in the long-term rental market, proving to be a formidable foe to the likes of Zillow Rentals and Apartments.com (Costar).

As Airbnb looks to solidify itself as the place to go when you need a stay of any length, associating with a name and company that has mastered the long-term market could bolster its brand as the “any stay” company. Zumper, on the other hand, has been experimenting with a Flex Living option and recently announced an MVP of Zumper Pass—a subscription for booking short-term stays.

Both are titans of their respective corners of the market on a complimentary yet competitive collision course. My guess is Zumper has a valuation in the $1-$2 billion range, a far cry from the $65+ billion market cap of Airbnb today, and certainly within the wheelhouse of the kings of proptech.

Maybe Zumpbnb will be enough to hold us over until the days of Zillbnb are upon us.

COSTAR ACQUIRES 3D

Matt Michalski // Co-founder, Aryeo

Costar acquires Matterport as it looks to execute on a similarly scary playbook that it has in commercial. That is, procuring and owning unique listing media to then build a moat between Costar and its competitors. Not only does Matterport possess leading 3D tech, but it owns the entire repository of Matterports created in the past year—all of the data within them—and has recently acquired VHT Studios, the largest real estate photography company in the US. Oh, and since Matterport’s 2021 SPAC, its stock is down nearly 90%, leaving it with a market cap of under $1 billion. If I’m Costar, I can’t let this deal slip through the cracks.

OPENDOOR TAKES TO PROPERTY MANAGEMENT

Drew Meyers // Founder, Geek Estate

In a financial pickle, Opendoor acquiring a tech-enabled property management company will make too much sense as part of building its marketplace. In what is now a two-horse race, the clear leader will nab a company such as Mynd, Darwin, or Pure to bring a guaranteed revenue generation vehicle in house for all homes on its balance sheet.

CONTECH CENTRAL

Stephen Del Percio // VP & Assistant General Counsel, AECOM

Infrastructure bill tailwinds finally propel the US construction industry forward. It’s been over a year since President Biden signed the federal infrastructure bill into law, promising over $500B in new spending on the nation’s roads, bridges, tunnels, ports, and airports over the next five years. But funding has been very slow to roll out and 2022 turned out to be a bit of a tease for us infrastructure nerds. That won’t be the case in 2023 – some big projects are on the verge of moving forward (Gateway Tunnel in NYC; the I-75 Brent-Spence Bridge replacement in Cincinnati) with many others in the pipeline. Expect a busy year in the civil infrastructure space, with plenty of knock-on impacts for stakeholders – from a continued brisk industry M&A pipeline to new startups addressing the talent shortage gap and archaic insurance markets, among many others.

The floodgates open in 2023 for renewable energy and EV charging projects in the US. Arguably the renewables space is already there; in 2022, for the first time, clean energy met over a full day’s demand on electric grids in California and Oklahoma. But in 2023 these types of projects will move into the civil infrastructure mainstream. We’ll continue to hear more about construction-related startups in the decarbonization space (which will require trillions of dollars in investment if the world is to reach carbon neutrality by the second half of the century). In the US, this will include carbon capture and EV charging; companies like Toronto-based SWTCH, which is focused on the multi-family and retail sectors, will grow and expand south of the border. IIJA money will fuel this boom, as will a push for local governments to implement innovative delivery methods to leverage the expertise of the private sector in delivering these sorts of solutions.

The fully autonomous vehicle market shrinks but assisted driving grows. On the heels of Carnegie Mellon-backed Argo.AI shutting down and legacy automakers like Ford reducing their investments in fully autonomous vehicles, 2023 will see other fully autonomous AV projects halt, shrink, or disappear. We’ll hear more about Apple’s electric car, which won’t be as autonomous as the public expects (or arriving anytime soon – now rumored to be pushed back to 2026). And assisted driving technologies will play a bigger role in projects that are funded under the IIJA, through companies like Alphabet-backed Cavnue.

Talent shortage forces legacy companies to merge or tech companies to absorb. Not social media but TSMC or Amazon bringing more functions in-house.

A DOUBLING DOWN ON COLLABORATIVE R&D

Dennis Steigerwalt // President, Housing Innovation Alliance

The pace of the homebuilding landscape in 2023 presents a significant opportunity to elevate solutions in overcoming housing supply and affordability issues.

2022 experienced a historically fast and deep drop in housing affordability, and it’s very likely that housing is permanently more expensive. 2020 began with a structural supply gap of around 1.5 – 2 million homes. To catch-up to current demand, the industry needs to deliver 1.7 million homes per year through the end of the decade. We nearly achieved this in 2021 with 1.6 million, but fell to 1.5 million in 2022—and experts forecast jus 1.2 and 1.4 million in 2023 and 2024.

In the face of the supply-demand gap, we continue to coordinate efforts on shared innovation initiatives. The paradox of cyclical industries investing in innovation is a function of time and money—we’re either too busy to invest or business is too slow to finance it. There are constant jabs thrown at the construction industry for its lack of productivity gains and investment into R&D, but that’s unfair. New ideas from top tier talent offer solutions for the industry, and an increasing number of highly visible, high impact projects are driving homebuilding forward.

We’ll continue to see significant investment in shared R&D along these pathways in 2023:

- Investments will expand the technology solution spectrum and enhance productivity in home delivery,optimizing project delivery in the field and at the factory. There will be new government investment through programs such as National Science Foundation innovation engines to create robust bio-region economies focused on the future of construction.

- M&A activity continues. Fueled in part by domestic cash reserves and market-timing, but also keep an eye on foreign capital flowing from countries with longer investment horizons and leadership teams firmly targeting projects grounded in ESG principles.

- Builders will design and deliver prototype homes to demonstrate how we can improve livability, reduce costs, and minimize the built environment’s footprint on the planet. Business practices to deliver low carbon construction will take hold in 2023. In a tight market, builders will win residential projects, and consumers, through this differentiation.

Closing

And, with that, that’s a wrap! Agree or disagree? What are we missing? Leave your thoughts in the comments.

Prior Geek Estate Predictions & Reflections

- Looking Forward to 2022: Climate Takes Center Court // Reflections

- 2021 Predictions // Reflections

- 2020 Predictions // Reflections

- 2019 Predictions // Reflections

- 2018 Predictions // Reflections

- 2017 Predictions // Reflections

Interested in all of our past predictions? Apply for a GEM Diamond Membership.