Weekly Radar #296: Fracking Green, Rates The Other Way

What's covered in this week's GEM Crystal Weekly Radar:

- Is it possible to use every part of a building to generate energy or sequester carbon? Logan dives into clean startup Modern Hydrogen and how the company is helping to reduce carbon emissions.

- The potential for another rate hike from the Fed will not be a boon for startups.

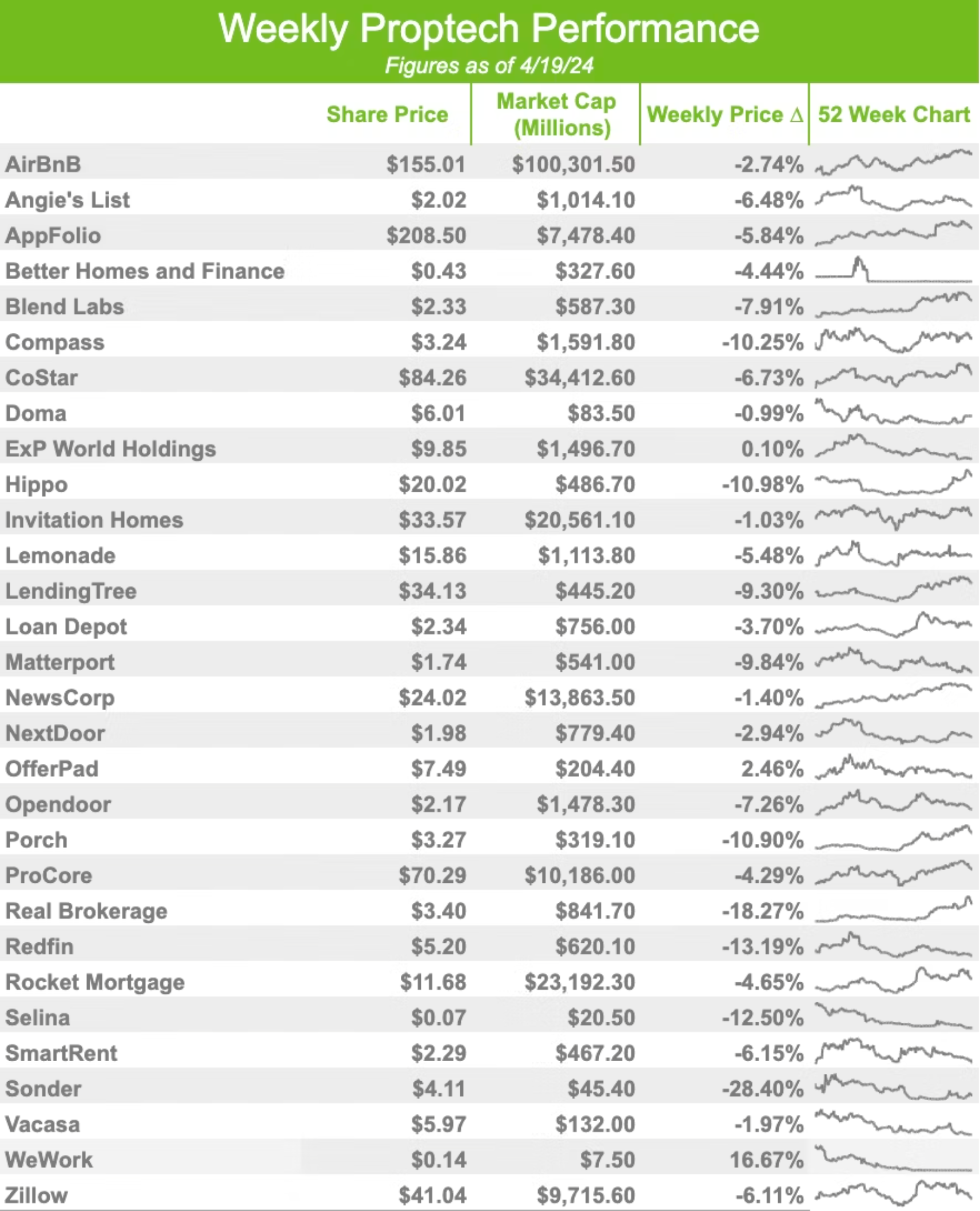

- Consisting of 30 stocks, the GEM Proptech Index had a combined market cap of $233.07B, a 3.90% decrease from the previous week.

Geek Estate Blog Recap:

Transmission Recap:

Drew covers how new technological shifts with AI and innovations will impact real estate in the coming decade. Before that, Dennis Steigerwalt dove into a few technologies that help real estate developers maximize water efficiency and minimize waste.

CLIMATE

FRACKING GREEN

By: Logan Nagel

Backed by Bill Gates, clean energy startup Modern Hydrogen’s asphalt sequesters carbon from natural gas and biogas energy generation, giving users another avenue to reduce carbon emissions at their real estate or infrastructure projects. Pre-covid, a frequently discussed commercial real estate topic was “asset fracking,” where every part of a building is broken apart and monetized—underutilized apartments repurposed as short-term rentals and community spaces rented for events, for instance.

This conversation is likely to become relevant once again, but with a new angle: using every part of a building to generate energy or sequester carbon. It’s not hard to imagine a near future where roofs are covered in solar panels or carbon capture devices, building energy systems can direct excess power back to the grid, windows like those made by Solar Windows generate energy, and parking lots sequester carbon. Further, in the years ahead, structural elements—either covered in plants or using carbon-injected concrete like CarbonCure’s—will offset or even outweigh carbon emissions elsewhere. All of these technologies exist in some form today, so what part of a building will be next to “green frack?”

STARTUPS

RATES THE OTHER WAY

By: Drew Meyers

In the latest edition of All-in Podcast, they spoke about the prospect that interest rates might be hiked rather than lowered this year due to hot inflation.

Inman covered the topic as well, exploring what the Federal Reserve raising rates would mean for the industry.

We're in for a rocky year in if that comes to fruition. Making it more expensive to buy houses isn't going to help the proptech vertical. No surprise, residential proptech stocks are seeing the impact. We'll see how our Proptech Index does when we report next, but it seems obvious we'll be down week-over-week...and for the foreseeable future.

BIZ INTEL

Proptech Index Update

Consisting of 30 stocks, the GEM Proptech Index had a combined market cap of $233.07B, a 3.90% decrease from the previous week.

GEM DIAMOND MEMBER NEWS

- RealReports partnered with the Southwest Multiple Listing Service (SWMLS). – Zach Gorman

- LeadingRE added AJ Canaria Creative Services to its Solutions Group. – Jeff Kennedy

- More than 15% of new listings in the U.S. now include a CubiCasa floor plan. – Aaron Smith, Harri Pesola, Kenon Chen, & Jeff Allen