Weekly Radar #321: Housing Factory², Co-owning Upside For The Little Guy, The 5 Ws and H of Angel Investing

In this Weekly Radar, we cover:

- Cuby’s Mobile Micro-Factory aims to solve logistical and skilled labor challenges in housing production, while leveraging partnerships with local operators.

- Pacaso’s new Reg A growth round enables small investors to participate in co-ownership opportunities, with leadership poised to address financial setbacks and continue expanding access to homeownership.

- The pitches at a16z’s demo day impressed with their clarity and strong traction.

- Ryan Coon shares his angel investment philosophy which emphasizes backing founders he knows, investing early, and supporting companies that align with his values across criteria such as who, what, where, when, why, and how.

- The GEM Proptech Index had a combined market cap of $233.355B, a .04% decrease from the previous week.

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

Geek Estate Blog Recap:

Transmission Recap:

Last week, Drew Meyers talked about how 40 year listing agreements have been rightly outed but securing long-term homeowner relationships doesn’t have to be predatory. Before that, Drew Meyers discussed how founders must be ready to answer key investor questions on distribution, unit economics, and leadership to secure funding.

CLIMATE

HOUSING FACTORY²

By: Logan Nagel

While firms like ICON made waves with their innovative machinery and 3D printing technology, Cuby’s differentiator is that their product—the Mobile Micro-Factory (MMF), which builds home components indoors using largely unskilled labor and can be deployed near the project build site (ie a mall parking lot).

As noted in this excellent deep dive from Cuby investor Packy McCormick, this solves the logistical challenges associated with shipping pre-built home components long distances to the job site via highway.

For one of the most ambitious technologies reshaping real estate, factory-produced homes have had a rocky start, with wins by Icon contrasted with dumpster fires at ❇️Katerra❇️ and ❇️Veev❇️. Taking notes from the winners and losers in ❇️their category❇️, Cuby offers a smart partnership model with local operators such as developers to fund these MMF installations. This aligns interests with capacity from an early stage, while also solving the skilled labor issue facing builders nationwide. Plus, Cuby claims to offer a 150-mile installation radius from a MMF site. A litany of smart but ultimately unsuccessful startups have claimed to have the housing shortage panacea—we will see if Cuby can rewrite the script.

REAL ESTATE

CO-OWNING UPSIDE FOR THE LITTLE GUY

By: Drew Meyers

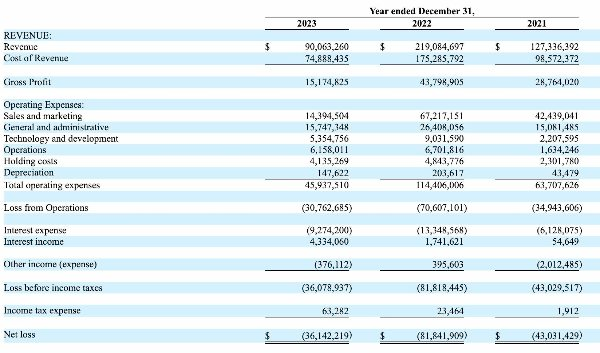

Pacaso announced a growth round under Regulation A ("Reg A"), according to a press release. That means both accredited and non-accredited investors can participate at $2.50 per share, with a minimum investment of $1,000. After having raised more than $230 million in equity financing across its Series A, B, and C rounds of venture capital, the goal of this round around $75 million (per Yahoo! Finance). According to some napkin math listed here, the valuation is $644 million. The investor deck can be found here.

Mike del Prete shared the financials on LinkedIn (SEC filing is here):