Weekly Radar #331: Intangibles, Parking Lot Robotics, A (Near) STR Unicorn, Fairly Or Barely?

In this Weekly Radar, we cover:

- The importance of intangible qualities by founders cannot be understated when it comes to securing VC funding.

- WeFunder's Jonny Price highlights the need for personalized outreach in successful crowdfunding campaigns.

- 215 Robotics targets parking lot maintenance with advanced robotics in a massive market.

- Hostfully has grown into a leader in short-term rental management software, recently attracting a major investment.

- Fairly’s revenue-sharing model raises doubts about scalability and service quality.

Happy holidays!

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

Latest from Geek Estate Blog:

Transmission Recap:

Last week, Drew Meyers shared FutureMoney's Junior Roth IRA concept and explores applying the strategy to create future homeowners. Before that, Rivers Pearce argued that the evolution driven by AI from “point and click” to “describe and done” is poised to finally unjam the current residential real estate tech adoption impasse.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

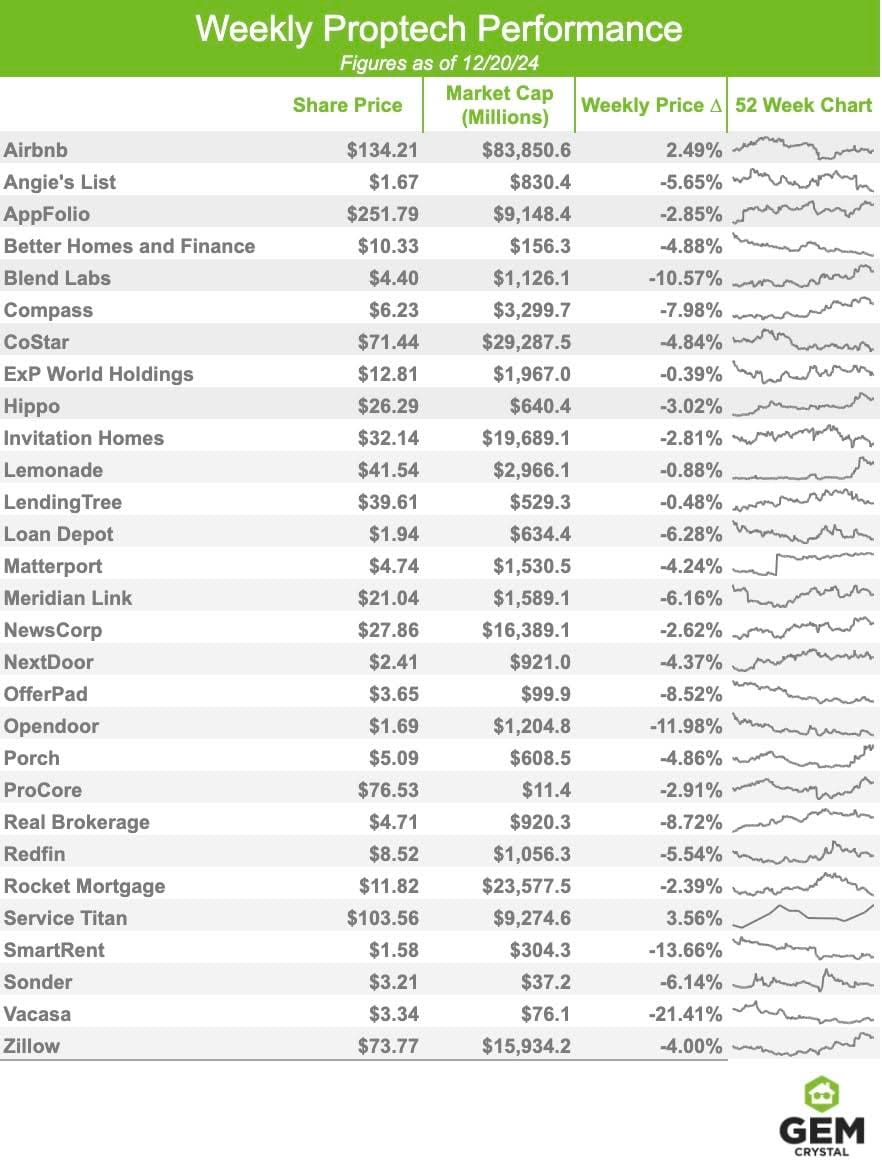

Consisting of 30 stocks, the GEM Proptech Index had a combined market cap of $314B. This week we added Intercontinental Exchange (ICE), which operates global financial and commodity trading platforms; Meridian Link (MLNK), which provides loan origination and customer engagement software for financial institutions; and ServiceTitan (TTAN), which offers field service management software for contractors, to the index.

Excluding the three new additions, the index had a market cap of $216.8B, a 7.1% decrease from the previous week. On Wednesday, the Federal Reserve announced a third consecutive interest rate cut of 2024, lowering its benchmark rate by 25 bps as inflation cools. However, in a setback for borrowers, the central bank signaled their plans to reduce rates less in 2025 than previously anticipated.

STARTUPS

INTANGIBLES ARE EVERYTHING

By: Drew Meyers

Following a Zoom or in-person VC pitch, NFX General Partner Omi Drory says there are two clear camps of sentiment in the follow-up discussion among VC partners:

Option 1: 100% energy. We want to run through a wall. Start due diligence right away. Call our partners and tell them about you.

Option 2: It’s quiet, and people shrug and look at each other. There’s just a feeling that this is not the one.

If you end up in Option 2, it's very hard to move to Option 1. So, first impressions matter. A lot. The truth can hurt:

Sometimes, when a VC doesn’t invest, it’s about you. Or, more accurately, their perception of you.

How do you avoid Option 1? Have one of the intangibles (ideally, multiple), and ensure they come through loud and clear in your pitch.