Weekly Radar #342: Removing Participation From Civic Participation, Rocket Goes All In On Real Estate, Proptech Index decreased 4.73%

In this Weekly Radar, we cover:

- Hamlet provides AI-driven summaries of municipal meetings to help real estate developers track policy discussions, but its success depends on whether developers value summarized dialogue over direct policy shifts.

- Rocket Companies' acquisition of Redfin for $1.75 billion positions it as a dominant force in real estate by integrating brokerage and mortgage services, challenging Zillow and raising concerns about the survival of independent brokers.

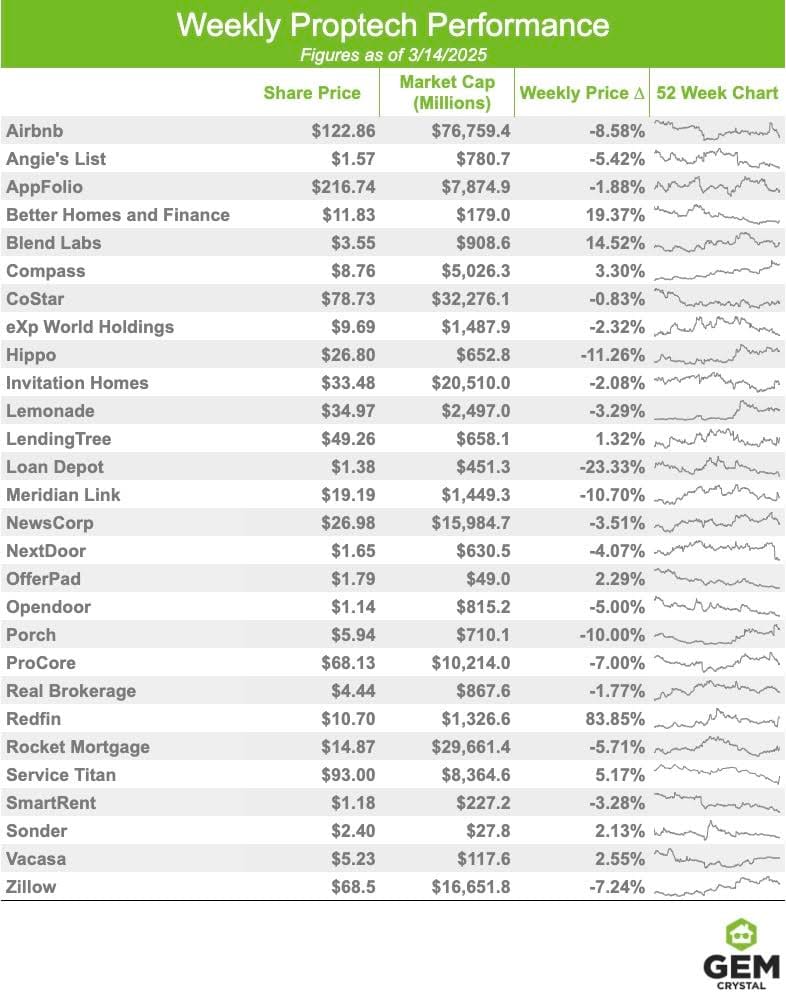

- The GEM Proptech Index decreased 4.73% from the previous week.

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

PS: We have a few spots left at the upcoming GEM Proptech Getaway in beautiful Central Oregon from April 1st-3rd. Reach out if you're interested.

Latest from Geek Estate Blog:

Transmission Recap:

Most recently, Drew Meyers examined how Real Brokerage is using banking and rewards to transform into a financial services company. Before that, Drew Meyers explored the Tesla-ification of motorhomes, with a new wave of fully electric, luxury vehicles and towables led by Lightship and Pebble coming to market.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

Consisting of 28 stocks, the GEM Proptech Index had a combined market cap of $237.16B, a decrease of 4.73% from the previous week.

PROPERTY DATA ECOSYSTEM INTELLIGENCE

By: Community Relations

Property facts (beds, baths, square footage, etc) and tax assessed values, sales dates and prices are crucial to building valuable products for home buyers, sellers, and investors. Those customer segments are all interested in the property, and accurate and comprehensive data about said parcel/address is table stakes.

That data originates from county recorder or assessor offices across more than 3,100 counties in the United States. The recorder offices log deeds, mortgages, and liens that tell ownership history. Assessor offices include parcel information (including boundaries), assessed values, land use, and tax records. Some of these offices are very tech forward and anyone can download the entire dataset in digital format. In other cases, these are still recorded on paper and a human has to retrieve them in person.

Non-disclosure States: In some states, sales prices are not a matter of public record. Those states are:

- Alaska

- Idaho

- Kansas

- Missouri (some counties)

- Mississippi

- Louisiana

- Wyoming

- Utah

- Texas

- North Dakota

- New Mexico

- Montana

In these states, MLS is the best (and only) source for products or services requiring access to sales prices. Mortgage-to-sale price ratios can be used to estimate final sales prices, but that will lead to many inaccuracies.

The first big decision is whether to source directly from county offices, or a third-party data aggregator. Going direct offers most accuracy and recency. Access can be fragmented; some counties have outdated digital systems. Third-party aggregators deliver standardized data across multiple counties with easier integration. They will all tell you they do data cleanup, de-dupe, update records based on customer issues. Many check data against multiple sources. However, data likely lags county records, and of course comes at an added cost.

CoreLogic (owned by Stone Point Capital), Black Knight, part of ICE, and First American Data & Analytics are the data providers that dominate from an awareness perspective. The CoreLogic acquisition of Data Quick in 2013 for $661 million took one major player out of the market. However, there are a variety of other resellers to consider, with ATTOM at the top of the well-known list.

The large data providers all offer dozens of data sets. No surprise: The more datasets and larger coverage areas you license, the less the per record/transaction costs end up being.

Selecting a property data provider is a huge decision. Switching costs are massive, given the data ingestion and integration will end up touching virtually every aspect of your tech stack. Don’t be swayed by introductory rates. Those won’t last, but your data provider will remain ingrained as a core part of your product for years. Once you do a full integration, ripping that out to insert a new data provider into the mix will be the last thing you’ll be excited about spending development resources on.

Questions to ask vendors:

- How frequently is the data updated? (Daily, weekly, monthly?)

- Where does the provider source its data? (MLS, public records, proprietary sources?)

- What does the license allow me to do with the data?

- What rights does this vendor have to the data, and do they have the right to sell it to me?

- Does the provider offer historical data for trends and forecasting?

- How many queries do I expect to make? (if pay-per-use pricing)

- Will I own the data in perpetuity? And, the related question, do I need to?

- What happens when I find incorrect data? Does the vendor correct it in their system, or am I expected to make my own corrections?

Without further ado, below are the property data providers to evaluate…

BUILT WORLD

REMOVING PARTICIPATION FROM CIVIC PARTICIPATION

By: Logan Nagel

Hamlet surfaces insights from public municipality meetings. These meetings can provide actionable intelligence on upcoming real estate investment opportunities as well as context around decision factors—for instance, did everyone boo when the transit-oriented incentive conversation opened up? Hamlet uses AI and human verifiers to comb through public meeting records to transcribe and summarize meetings, quotes, and regulatory updates, to help developers understand the trajectory of policy discussions and keep tabs on the dialogue surrounding their own projects.