Weekly Radar #343: Unpacking The Rocket & Redfin, Largest Institution SFR Buyers, My Journey Through The Uncanny Valley With Sesame’s Conversational Voice, Proptech Index increased 1.51%

In this Weekly Radar, we cover:

- PadSplit Founder and CEO, Atticus LeBlanc, argues that cities should incentivize homeowners with cash to rent out spare bedrooms to address affordable housing needs more efficiently than new construction.

- SFR Analytics identifies the top institutional single-family home buyers of 2024, highlighting a mix of iBuyers, wholesalers, flippers, and SFR funds.

- Companies like WithJoy.ai, Relm, Ridley, and Reeve are experimenting with commission-free or flat-fee real estate models, but skepticism remains about their long-term viability and ability to shift consumer behavior.

- Rocket Companies' $1.75B acquisition of Redfin reflects a strategic bet on creating an end-to-end homebuying "Superstack," though investors are wary of whether the integration will generate expected synergies amid changing commission structures and stiff competition from Zillow and CoStar.

- Sesame's release of its highly realistic voice model CSM-1B raises ethical concerns due to its unsettling realism and lack of safeguards, prompting fears that misuse could lead to deceptive or harmful outcomes.

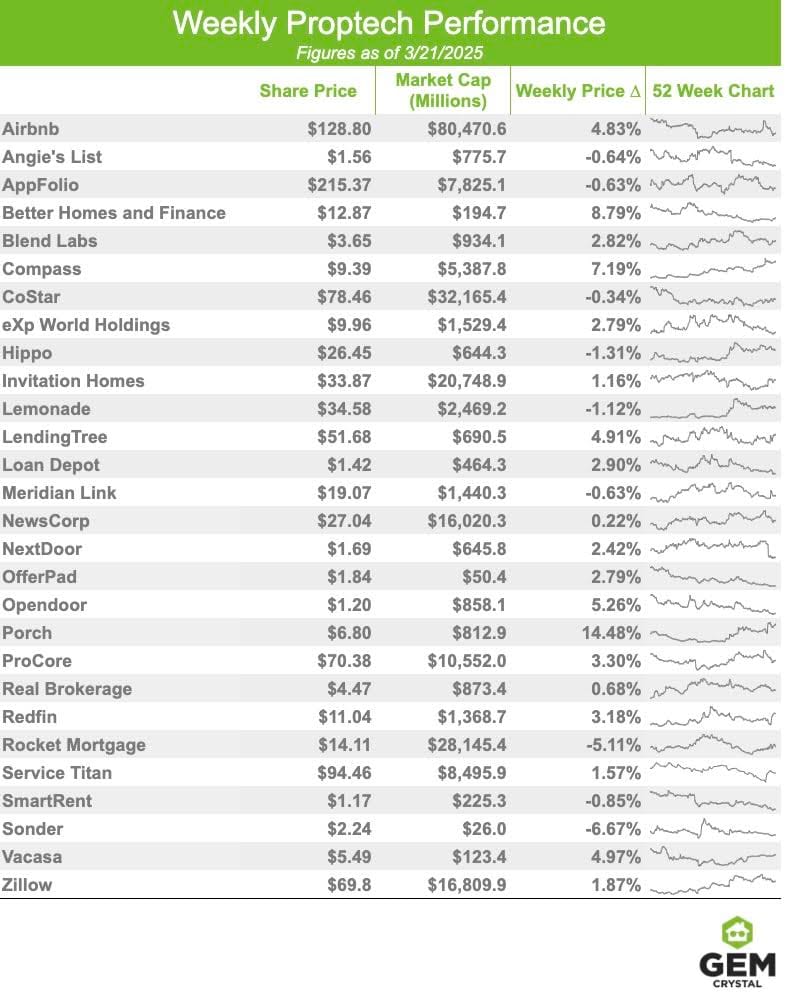

- The GEM Proptech Index creased 1.51% from the previous week.

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

PS: We have a few spots left at the upcoming GEM Proptech Getaway in beautiful Central Oregon from April 1st-3rd. Reach out if you're interested.

Latest from Geek Estate Blog:

Transmission Recap:

Last week, Drew explored whether the next major MLS tech disruption isn’t a desktop/mobile experience, but one that eliminates the need for a traditional interface at all. Before that, Drew examined how Real Brokerage is using banking and rewards to transform into a financial services company.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

Consisting of 28 stocks, the GEM Proptech Index had a combined market cap of $240.748B, an increase of 1.51% from the previous week.

AFFORDABILITY

ULTIMATE HOUSING INCENTIVE: CASH

By: Drew Meyers

There's plenty of available housing stock in the United States, in the form of unused bedrooms. Apartment List reported that, "As of 2021, there are 137.2 million spare bedrooms against a deficit of 24.2 million, putting the total number of excess bedrooms at 113 million, an increase of more than 27 times compared to 1970." Meanwhile, Realtor.com released a report stating that "the number of extra bedrooms in the U.S. reached 31.9 million [in 2023], up from 31.3 million the year prior and over four times the 7 million extra bedrooms the country had back in 1980." Regardless of what the exact number is, it's in the tens of millions.

In One Room at a Time, Atticus LeBlanc lays out a compelling argument for cities looking to address their housing crisis: paying homeowners to rent empty bedrooms in existing homes. Compared to building apartments, the math is obvious: