Weekly Radar #350: Proptech Index Down 1.68%, Rocket Q1 - 2025 Earnings

In this Weekly Radar, we cover:

- It's earnings season...we published seven summaries last week and a full recap is coming later this week.

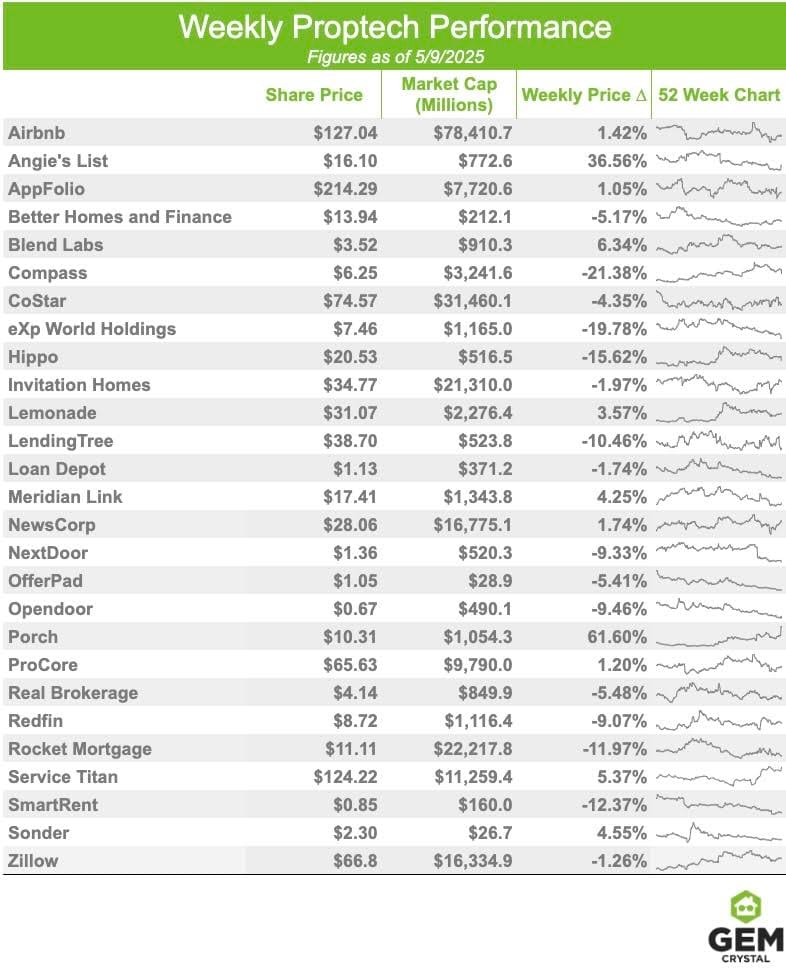

- The GEM Proptech Index decreased 1.68% from the previous week.

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

Latest from Geek Estate Blog:

Transmission Recap:

Last week, Drew Meyers explored Airbnb tightening up its off-platform bookings and payments rules and ponders the future of the STR portal category. Before that, Drew Meyers shows what he and Nate Smoyer built over the past month using Replit, and talks about how no-code AI tools have made it possible to build market-ready products, shifting the competitive focus from product development to distribution and trust as the new differentiators.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

Consisting of 27 stocks, the GEM Proptech Index had a combined market cap of $230.86B, a decrease of 1.68% from the previous week.

Porch Group shares surged 68% after reporting a surprise $8M profit in Q1 and raising its full-year outlook, closing the week up 61.6%. The strong results were driven by its insurance segment, which benefited from a shift to managing policies for fees rather than selling them directly. Revenue reached $84.5 million with an 82% gross margin.

Additionally, we removed Vacasa from the index following its official delisting from the Nasdaq on May 2nd. The move comes as part of its completed merger with Casago Holdings, LLC, marking Vacasa’s transition to private ownership and a new chapter in its growth.

ROCKET - Q1 2025 EARNINGS

By: Community Relations

[Note: This earnings report marks the first time Rocket is included in primary coverage for the GEM Proptech Index Quarterly Report, replacing Redfin following Rocket’s acquisition of the company on March 10. Commentary on the deal is available in Nima Wedlake’s article here.]

Rocket reported Q1 2025 total GAAP revenue of $1.04B, down 25% YoY. GAAP net loss was $212M, compared to net income of $291M in Q1 2024. Closed loan origination volume was $21.6B, a 7% increase YoY, and net rate lock volume (total locked loan volume net of fallout and cancellations) grew 17% YoY to $26.1B.

Notable Takeaways: