Weekly Radar #354: 52,000 Residences Strong, At the Buyer Demand Table, Regulation For Landlords = Adoption For Rental Tech, Proptech Index Increased 4.54%

In this Weekly Radar, we cover:

- Compass’ Buyer Demand Tool is neither novel nor innovative compared to longstanding tools from the likes of RealScout and Percy.

- New landlord regulations in California are accelerating adoption of compliance and screening tech like Rely, RentSpree, Rental Beast, and Verifast.

- Alfred’s merger with Quarterra is a bold step toward creating a comprehensive operating system for multifamily housing, backed by a long-standing commitment to improving both NOI and resident satisfaction.

- The GEM Proptech Index increased 4.45% from the previous week.

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links, please consider GEM Diamond membership.

Latest from Geek Estate Blog:

Transmission Recap:

In the real estate portal arms race, Zillow, Rocket + Redfin, and Movoto + Lower are all chasing the same prize: owning the entire consumer journey. As a consumer, Drew Meyers is left wondering: What does that even mean? Previously, we brought you GEM's latest Biz Intel: Proptech Earnings Radar for Q1 2025.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

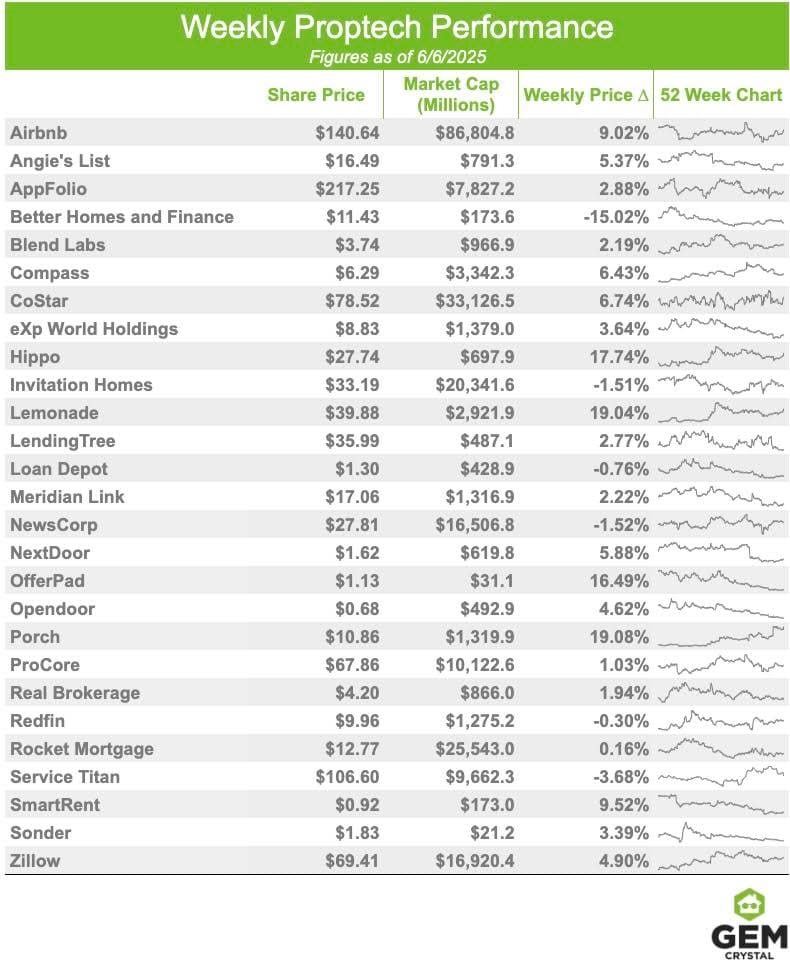

Consisting of 27 stocks, the GEM Proptech Index had a combined market cap of $244.16B, an increase of 4.54% from the previous week.

REAL ESTATE

AT THE TABLE AGAIN WITH BUYER DEMAND

By: Drew Meyers

In Dan Cooper's Linkedin post, he shared a screenshot from Compass CEO Robert Reffkin outlining a plan to launch a new Buyer Demand Tool...

So, Compass' new tool is like ❇️RealScout's buyer graph from 2018❇️? Or Buyside (re-branded to Percy)? Every (good) IDX offering brings visibility to saved searches already. Zillow has far more saved search data than anyone (by a mile). That data was used as inputs to their iBuying business and is no doubt integral to their offer strategies tool.

I won't go so far as to say it's bringing a tool back from the stone age (but physical books surely is), but a Buyer Demand Tool is not innovative or new. That's not to say I think Compass' strategy is bad. It's not. What I have a problem with is the grandstanding months ahead of a product launch that has existed for years already. Instead, how about Compass simply build the product, launch it, and execute? As you already know, my patience with Compass' spin ❇️is teetering on the edge of expiration❇️.

And, Dan Cooper is right, the bigger opportunity extends beyond the walls of any one broker/franchise--"a buyer-sided, workflow integration for MLSs to power more exchange within the entire MLS Network."

REGULATION FOR LANDLORDS = ADOPTION FOR RENTAL TECH

By: Drew Meyers

In California, AB 2493 has impacted the way landlords and property managers operate. That means two things, applications are processed on a first-come, first-served basis and application fees for unselected tenants must be refunded (within 30 days of application, or 7 days of being notified). A written version of a landlord's screening criteria is required to be provided to applicants. Another law, AB 2747, mandates that landlords provide tenants the option to have their rent payments reported to the credit reporting agencies.