Weekly Radar #364: Violating Customer Trust, Equity To Bitcoin, Private Funding Report - Q2 2025, Proptech Index Up 4.95%

In this Weekly Radar, we cover:

- Proptech Angel Group released high level Q2’25 stats with Series B rounds leading in dollars and Seed rounds leading in volume, while construction and residential dominated funding activity and hospitality/retail/STR sectors saw steep investor pullback.

- Buildium faces backlash for selling renters add-on products without permission, reinforcing the opinion that trust violations are the cardinal sin in company-building.

- Horizon’s model of converting home equity into Bitcoin investments is little more than a lead-gen wrapper on existing providers like Unlock.

- The GEM Proptech Index increased 4.95% from the previous week.

Geek Estate’s Proptech Getaway, an intimate (founders and C-suite) retreat for the brightest minds in proptech, is back for the 3rd year running…taking place in beautiful Central Oregon at Juniper Preserve April 28-30th, 2026. An exclusive gathering for GEM Diamond members. Are you coming?

Latest from Geek Estate Blog:

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links or attend our curated gatherings (lunch and breakfast this week in San Diego during Inman, dinner in Vegas during Blueprint, NYC dinner during CREtech in October), please consider GEM Diamond membership.

Transmission Recap:

This week, we bring you GEM's latest Biz Intel: Proptech Earnings Radar for Q2 2025. Previously it was an AI week, with a two part Transmission. In Part I, Seth Siegler shared pros, cons, and use cases for a range of AI tools used across the eXp org. In Part II, Jered Dennis reflected on how he went from a non-coder to someone who can independently build a near-complete native mobile app.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

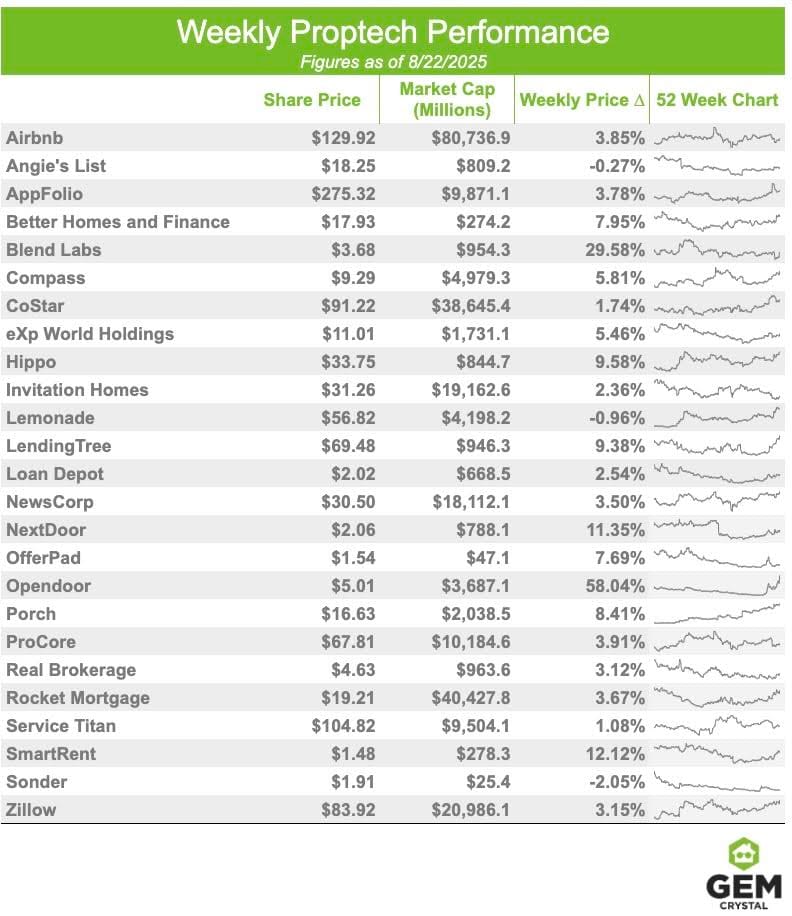

Consisting of 25 stocks, the GEM Proptech Index had a combined market cap of $270.865B, an increase of 4.95% from the previous week.

Shares of Blend surged 29.58% this week because of increased institutional interest, as Canaccord Genuity reiterated a “buy” rating with a $5.25 target on August 22 (implying 50%+ upside).

PRIVATE FUNDING REPORT - Q2 2025

By: Community Relations

Matt Knight and the team at Proptech Angel Group track the private funding activity across the proptech ecosystem. Below are the high level Q2’25 stats:

- 142 funding rounds were announced - view the data here.

- Globally, $3.565B raised.

- $7.3M was the median round size, and $28.8M was the average.

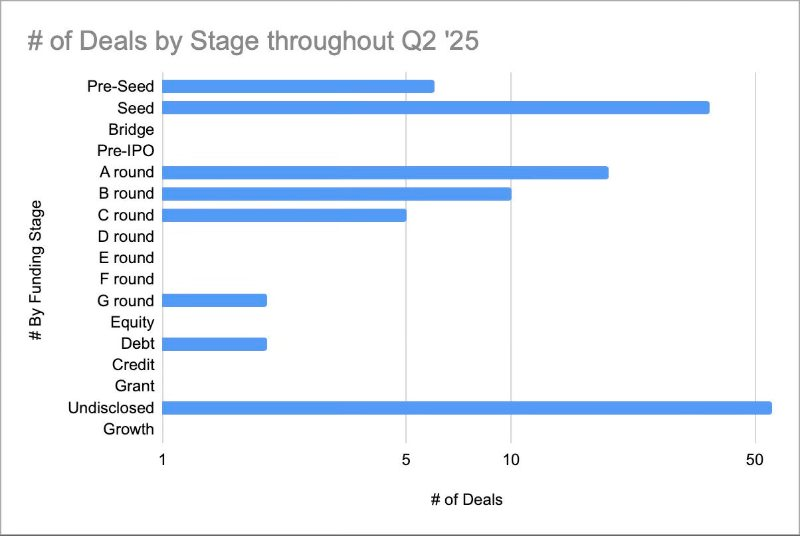

- Top 3 recurring investment stages:

- 37 Seed rounds

- 19 A Rounds

- 10 B Rounds

- Series B rounds led in dollars raised, while Seed rounds led in number of deals - indicating a healthy balance of risk and reward between later-stage company investments, alongside support for early-stage innovation.

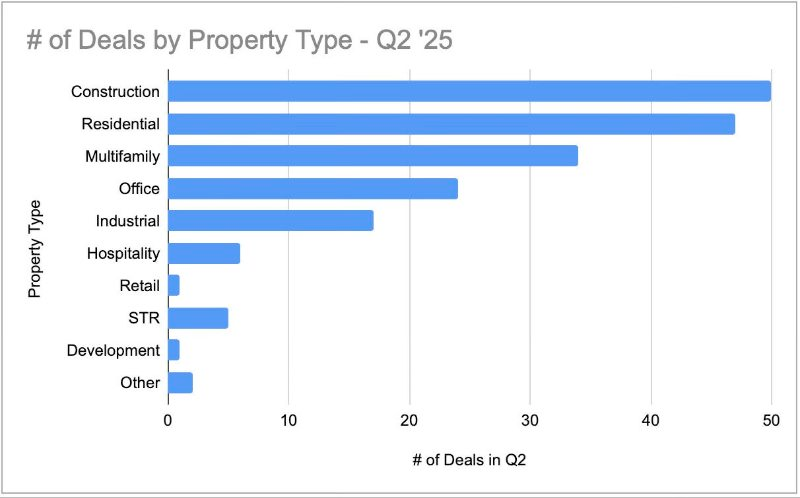

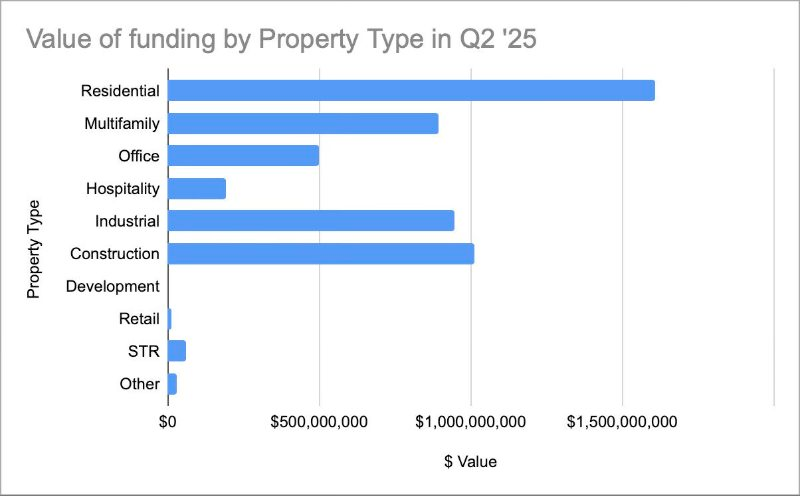

- Construction had the most number of deals - 50, with a total $1B raised.

- Residential had the highest total raised - $1.6B across 47 deals.

- Industrial saw $939M raised across 17 deals.

- Multifamily saw $895M raised across 34 deals.

- Office saw $496M raised across 24 deals.

- Hospitality, Retail, and STR dropped in both volume and funding compared to Q1’25, reflecting further investor caution.

Originally published on Vertical: https://verticaltech.substack.com/p/what-matters-this-week-71925.

GEM DIAMOND MEMBER NEWS

- TurboHome welcomed Jake Shuler as General Manager of Texas. -- Ben Bear

- Bonus Homes launched a homeownership and wealth creation model in Phoenix with $65.5M funding round. -- Jason Whitt

- Voiceflip partnered with Doorify MLS. -- Kurtis Cicalo

- Robert Hahn and Greg Robertson had Coleton Boyer on Industry Relations for a spirited debate on whether AI will truly disrupt the real estate industry.

- PadSplit announced their listings are now live on Zillow. -- Atticus LeBlanc, Errol Samuelson, Nobu Hata, and Steve Lake

STARTUPS

VIOLATING CUSTOMER TRUST

By: Drew Meyers

In company-building, violating the trust of your customers is a cardinal sin. Which is unfortunate for Buildium, because that's precisely what they did. Peter Lohmann, CEO of RL Property Management, mentioned on Linkedin that Buildium is selling financial products and other services (moving services, Livble, renter's insurance, and rent reporting) to his customers (renters) without obtaining permission.

Trust is everything. And that's becoming more and more true by the day as more noise (much of it AI-generated) infiltrates the the world. Remember, just because your terms of use say you can do something that stands to benefit your bottom line, doesn't mean you should.

BLOCKCHAIN

EQUITY TO BITCOIN

By: Drew Meyers

Apparently, there is a new use for home equity: invest in Bitcoin.