Weekly Radar #366: Don't Bury Your Startup Risks Lead, The Goat Of Company Updates, Proptech Index Up 1.87%

In this Weekly Radar, we cover:

- Atticus LeBlanc’s consistent weekly updates on Padsplit demonstrate growth, deep operational knowledge, and transparent communication, making him a model for founders seeking to attract investors.

- F4 Fund’s David Kaye argues that the best founders win bigger checks by candidly sharing risks and failed experiments—clarity and honesty matter more than inflated projections.

- Companies like Blockbuster, Kodak, and BlackBerry illustrate how failing to adapt strategy leads to irrelevance, and founders must maintain disciplined focus and market awareness to avoid similar decline.

- The GEM Proptech Index increased 1.87% from the previous week.

Geek Estate’s Proptech Getaway, an intimate (founders and C-suite) retreat for the brightest minds in proptech, is back for the 3rd year running…taking place in beautiful Central Oregon at Juniper Preserve April 28-30th, 2026. An exclusive gathering for GEM Diamond members. Are you coming?

Latest from Geek Estate Blog:

https://geekestateblog.com/apply-for-pitch-battle-competition-at-nar-nxt-2025/

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links or attend our curated gatherings, please consider GEM Diamond membership.

Transmission Recap:

This week, Drew Meyers explains the reality that humans' attention is a finite resource, which breaks the AI personalized outreach pitch. Most recently, we brought you GEM's latest Biz Intel: Proptech Earnings Radar for Q2 2025.

BIZ INTEL

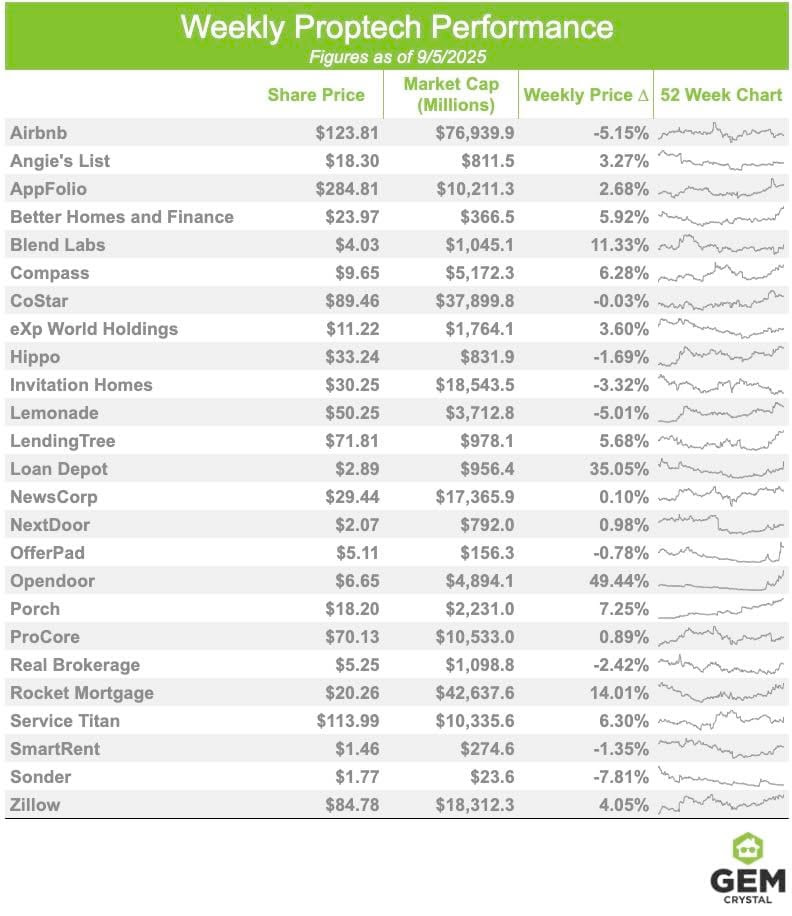

PROPTECH INDEX WEEKLY

By: Community Relations

Consisting of 25 stocks, the GEM Proptech Index had a combined market cap of $267.888B, an increase of 1.87% from the previous week.

GEM DIAMOND MEMBER NEWS

- Stackpoint welcomed Liz Haerling as its new CFO. – Adam Pase, Chris Kelly, and Matt Zisow

- Perchwell partnered with Baldwin REALTORS®. – Brendan Fairbanks

- Final Offer partnered with Keller Williams One West and launched in Texas. – Nathan Dart and Tim Quirk

- New Western announced a national partnership with PadSplit. – Kurt Carlton and Atticus LeBlanc

- Marci James joined the advisory board of Maverick Systems. – Diana Zaya

- Notable announced a partnership with FirstTeam® Real Estate and the launch of Flex. – Austin Lane and Max Kuhl

- Bright MLS, First Multiple Listing Service (FMLS), and the MIAMI Association of REALTORS® (MIAMI) announced an expansion of their collaboration.-- Ken Schneider

- Crib Equity partnered with Jason Mitchell Group. – Skye Laudari

STARTUPS

THE GOAT OF COMPANY UPDATES

By: Drew Meyers

Over the past seven years, Atticus LeBlanc (with the help of his team in some cases) has published 364 weekly updates for Padsplit. That's 3,000 pages of content. I'm on his distribution list and, while I don't read every update, three things stand out:

- Padsplit is growing.

- Atticus knows his business inside and out.

- Updates are not only being sent when Atticus/Padsplit needs something.

- His writing ability is pure gold. (If convincing him to write for GEM rather than build Padsplit was a remote possibility, I certainly would).

Regular investor, friends, and family updates are one of the ways to increase the chances of becoming

the hunted rather than the hunter in the fundraising quest

. If you decide to prioritize regular business updates (say yes and do it) and seeking someone emulate, Atticus is the GOAT.

DON'T BURY YOUR STARTUP RISKS LEAD

By: Drew Meyers

David Kaye, Founder and General Partner at F4 Fund, shared great advice related to fundraising:

The best pitch I ever heard spent 10 minutes explaining why their startup would probably fail.

Most founders pitch armed with hockey stick projections and TAM slides showing how they'll capture 1% of a trillion-dollar market. This founder opened with: "Here are the three reasons we're most likely to die."

I wrote a check.

Great founders aren't delusional optimists. They're paranoid optimists. They see the future clearly enough to bet their careers on it, but they obsess over every pothole that could derail them.

The best investor updates I get follow the same pattern. They don't bury the lede with vanity metrics. They open with: "Here's our biggest unsolved problem." Then they show me three experiments they're running to crack it. When those fail (and most do), the next update shows three new approaches.

This isn't about being negative. It's about being honest.

Startups die from unacknowledged problems, not acknowledged ones. The founder who can articulate why they might fail is the founder who won't.

Think about it: If you can't identify your biggest risks, how can you possibly be running the right experiments? If you're not transparent about your challenges, how can your investors actually help?

One F4 portfolio company got a 10x larger check from us not because of their traction, but because of their clarity. Every update was a masterclass in problem-solving. They weren't winning yet, but I knew they would.

Your biggest weakness is pretending you don't have any.

I could not agree more. So, what are the likely culprits for your startup ending up in the scrapyard? Every smart investor is running those risks in their head already. Are you hiding those core problems/challenges, or addressing them head on? Regardless of how "front and center" you are with address the business risks in front of you, whatever you do, don't be defensive when probed on those problems in need of overcoming.

If a founder's pitch competition presentation focused on "why our company will fail" and what they are doing about it...I'd pay closer attention than the rosy "everything in sunshine and rainbows" pitch normally presented.

STRATEGIC DRIFT: HOW FOUNDERS LOSE FOCUS (AND HOW TO GET IT BACK)

By: Jesse Garcia

When you’re wearing ten hats, it’s easy to confuse motion with progress. Calls, meetings, hiring, product tweaks, putting out fires—your days are full. But busyness doesn’t always equal business growth. Hidden in that grind is a silent killer of companies: strategic drift.

What Is Strategic Drift?

Strategic drift is the gradual failure of a company’s strategy to adapt and evolve with a changing business environment. It happens quietly. One quarter you’re in sync with your market, the next you’re lagging, and before long you’re irrelevant.

Drift sets in when leaders stick to yesterday’s playbook while the field has already shifted—whether through new technologies, shifting customer expectations, or economic pressures. Over time, the gap between your strategy and the market reality widens until your competitive advantage disappears.

You’ve heard the phrase:

“Insanity is doing the same thing over and over, expecting different results.”

That’s the essence of strategic drift. What worked 5 years ago—or even 6 months ago—might not work today.

Famous Failures of Strategic Drift

- Blockbuster doubled down on its physical store model even as Netflix proved customers preferred streaming. Their refusal to adapt cost them everything.

- Kodak invented digital photography but clung to film sales. Their hesitation opened the door for competitors who captured the new market.

- BlackBerry focused on physical keyboards while Apple redefined mobile with touchscreens. Once the leader, they quickly became an afterthought.

The lesson: winning today doesn’t guarantee winning tomorrow.

How Founders Fall Into Drift

Founders and executives don’t drift because they’re lazy—they drift because they’re busy. Some common traps:

- Wearing too many hats. You’re buried in operations instead of monitoring the market.

- Chasing noise. Every new idea feels like an opportunity, but you end up scattered.

- Relying on past wins. “It worked before, so it will work again” becomes the silent mantra.

- Avoiding hard pivots. Change feels risky, so you double down on the familiar—even if it’s fading.

How to Re-Center and Realign

Getting out of drift doesn’t require blowing up your business—it requires simplifying and refocusing:

- Revisit Your Foundation. Ask: What problem are we solving? For whom? Why now? If your answers sound fuzzy, it’s time to recalibrate.

- Set Clear, Measurable Goals. Vague ambitions like “grow revenue” won’t keep you grounded. Define numbers, timeframes, and milestones.

- Audit What’s Working. Look at your last 90 days. Which activities actually drove growth? Which just drained time? Double down on the former, cut the latter.

- Stay Market-Aware. Build a rhythm of scanning the horizon—customer feedback, competitor moves, new tech shifts. Strategy must live, not sit on a shelf.

- Create Accountability. Whether it’s a coach, board, or trusted peer, have someone who pushes you to focus and adapt. Drift thrives in isolation.

The Founder’s Edge

Founders who avoid drift aren’t necessarily the smartest or the fastest—they’re the most disciplined about focus. They cut noise, clarify goals, and adjust course before the market forces their hand.

The reality is, drift is natural. Every company will face it. The difference between decline and scale is whether you notice it—and how fast you act.

So here’s the question for you:

Where in your business have you mistaken motion for progress?

Take a moment this week to step back, assess, and make the small shifts now—before drift becomes downfall.

[Originally published on Linkedin.]