Weekly Radar #383: Kicking Institutionals to the Curb, a Homes.com "Duh" Moment, Proptech Index up 7.29%

In this Weekly Radar, we cover:

- President Trump plans to ban institutional investors. We've heard this before, and are highly skeptical of the potential affordability impact.

- Homes.com is cutting marketing spend. We all saw that one coming.

- The GEM Proptech Index increased 7.29% from the previous week.

Geek Estate’s Proptech Getaway, an intimate (founders and C-suite) retreat for the brightest minds in proptech, is back for the 3rd year running…taking place in beautiful Central Oregon at Juniper Preserve April 28-30th, 2026. An exclusive gathering for GEM members. Are you coming?

New GEM Members

Latest from Geek Estate Blog:

As always, links surrounded by the ❇️ emoji indicate exclusive GEM content. If you would like to have access to all links or attend our curated gatherings, please consider GEM membership.

Transmission Recap:

Most recently, Drew Meyers highlights the major developments of 2025, and GEMineers reflect on their 2025 predictions and trends published a year ago. Before that, GEM's 2026 predictions dropped, with AI Madness the broad theme for the coming year.

AFFORDABILITY

KICKING INSTITUTIONAL INVESTORS TO THE CURB

By: Drew Meyers

"President Trump on Wednesday took to Truth Social to announce that he would be 'immediately taking steps' to ban institutional investors from buying single-family homes," according to Inman.

It was inevitable ❇️this idea❇️ would resurface. It doesn't change the reality that, with institutionals making up only 3% of the US housing stock, such a policy will not make any meaningful dent whatsoever in the push to make housing affordable. And to add on to all of that, proclamations are easy…especially for someone who says a lot of things. Putting that into law is a much more arduous endeavor.

Kurt Carlton's take on Linkedin is worth paying attention to:

15 million vacant and aging homes.

That’s the real opportunity to fix housing affordability.

I appreciate the focus on keeping the American Dream alive, but affordability doesn’t improve by restricting a tiny slice of the market. Institutional buyers represent less than 2% of home purchases. Even a full ban barely moves the needle.

The real supply solution is already working: local investors.

In 2025, local investors revitalized more homes than builders for the first time ever. They’re taking vacant and unlivable houses and turning them into affordable homes families can actually buy, often first-time buyers. These homes are already zoned, already in neighborhoods, already connected to infrastructure. They’re the fastest way to add inventory.

If we want real impact, policy should support the small, community-rooted investors restoring supply, not slow them down with broad restrictions aimed at Wall Street.

More homes comes from renovation, not regulation.

BIZ INTEL

PROPTECH INDEX WEEKLY - AS OF 1/9/2026

By: Community Relations

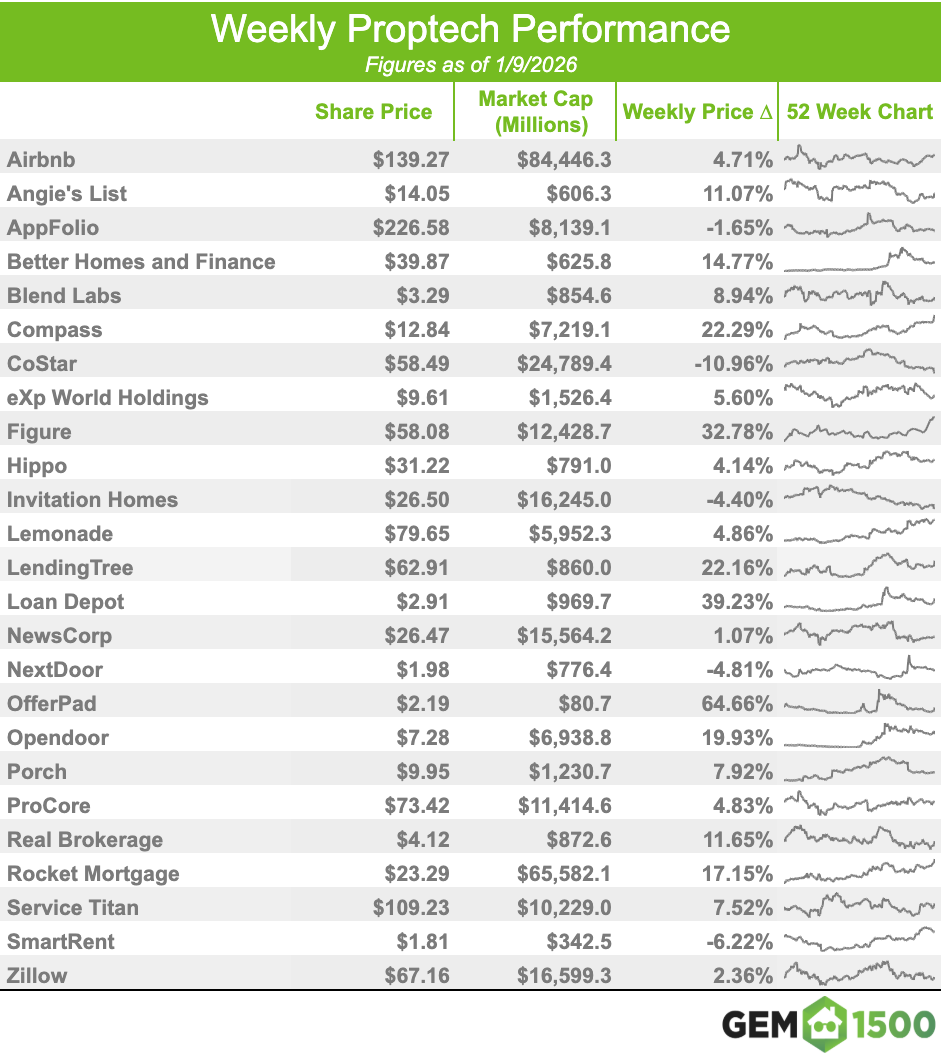

Consisting of 25 stocks, the GEM Proptech Index had a combined market cap of $295.085B, an increase of 7.29% from the previous week.

The index saw its highest week-over-week percentage gain since inception, spanning more than two years of tracking, primarily driven by the announcement of a $200B mortgage-backed securities purchase shared by President Trump on social media.

The previous highest week-over-week gain occurred on 2/14/2025, when the index rose 6.65%, largely fueled by a strong Q4 FY24 earnings report from Airbnb.

GEM MEMBER NEWS

- RentSpree launched Landlord Pro that includes a banking solution to help small landlords to better manage property finances. — Michael Lucarelli and Lauren Martin

- Shovels acquired ReZone to add local government meeting intelligence to its platform. — Ryan Buckley and Brad Hargreaves

REAL ESTATE

HOMES.COM CUTS MARKETING SPEND

By: Drew Meyers