Weekly Radar #367: $7 Billion In Value, The Opendoor Saga Continues, Legal Mumbo Jumbo, Proptech Index Up 1.57%

In this Weekly Radar, we cover:

- Figure’s $7B IPO and rising share price is seen as a rare liquidity win for proptech investors and a validation of blockchain’s role in real estate finance.

- Opendoor’s leadership shakeup, AI-driven reset, and founder return are viewed skeptically as PR spin masking its reality as an undifferentiated seller lead platform, though some compare the shift to a “Marvel reboot for iBuying.”

- Compass’s hire of NAR’s former lead trial attorney underscores its litigious posture, but the opinion is bluntly dismissive of lawsuits as a sustainable industry strategy.

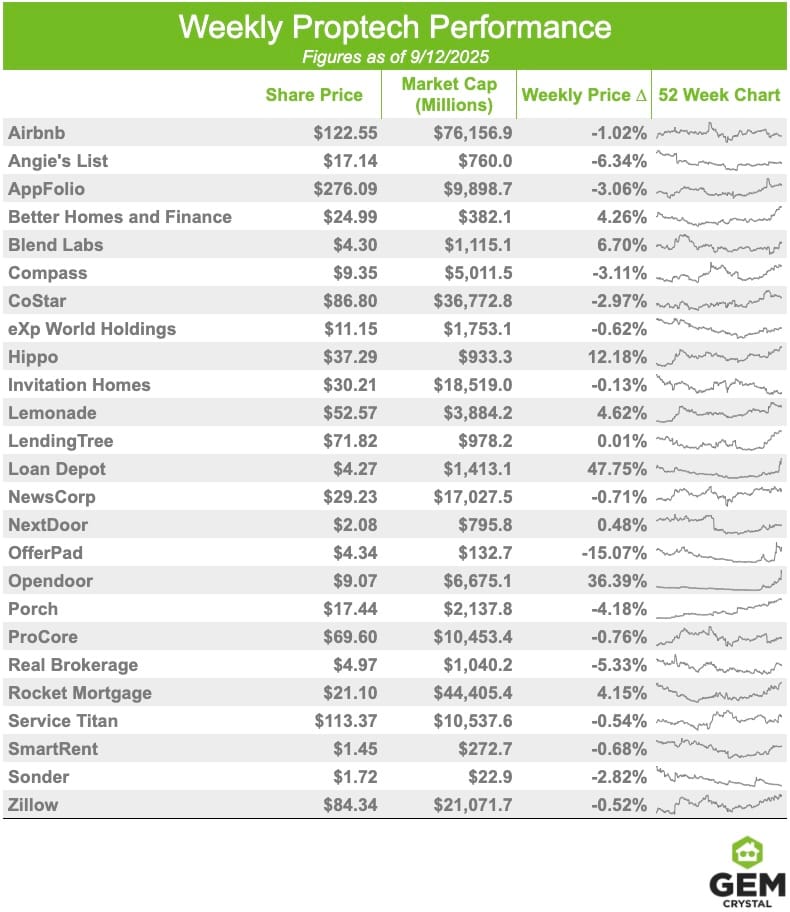

- The GEM Proptech Index increased 1.57% from the previous week.

Geek Estate’s Proptech Getaway, an intimate (founders and C-suite) retreat for the brightest minds in proptech, is back for the 3rd year running…taking place in beautiful Central Oregon at Juniper Preserve April 28-30th, 2026. An exclusive gathering for GEM Diamond members. Are you coming?

Latest from Geek Estate Blog:

As always, links surrounded by the ❇️ emoji indicate exclusive GEM Diamond content. If you would like to have access to all links or attend our curated gatherings, please consider GEM Diamond membership.

Transmission Recap:

Last week, Drew Meyers explained the reality that humans' attention is a finite resource, which breaks the AI personalized outreach pitch. Most recently, we brought you GEM's latest Biz Intel: Proptech Earnings Radar for Q2 2025.

BIZ INTEL

PROPTECH INDEX WEEKLY

By: Community Relations

Consisting of 25 stocks, the GEM Proptech Index had a combined market cap of $272.151B, an increase of 1.57% from the previous week.

This week, Opendoor, still riding the retail investor wave, named former Shopify COO Kaz Nejatian as CEO, with co-founders Keith Rabois returning as chairman and Eric Wu rejoining the board.

GEM DIAMOND MEMBER NEWS

- Applications are open for the 2026 Real Estate Innovation Hub. – Mike DelPrete

- Listen to Dalip Jaggi on the Listing Bits podcast. – Greg Robertson

- Maverix Advisory Group welcomed Matthew Ferrara as the newest member of their Advisory Board. – Jeff Kennedy

- Ocusell announced a collaborative rollout with MoreMLS, All Jersey MLS, and SIMLS, to launch Ocusell List across all three MLSs simultaneously. – Hayden Rieveschl

- Acres welcomed new VP of Sales, Parker Stewart. – Carter Malloy

BLOCKCHAIN

$7 BILLION IN VALUE

By: Drew Meyers

The GEM Proptech Index will have another entry: Figure (we'll add to our tracking list next week).

Listed as FIGR on the NASDAQ, "Blockchain-based home equity lender Figure Technology Solutions Inc. has a market capitalization of nearly $7 billion following strong investor demand for its shares in an initial public offering this week," according to Inman. With an initial price of $25 per share, $787.5 million was raised, "of which $587.6 million went to Figure and $199.8 million to existing stockholders." Shares are currently trading at $32.50 (as of 9/14/2025).

Another IPO, especially with strong share price growth, is badly needed. Liquidity events is the only means to increase investor confidence in the proptech vertical that has fallen out of favor. And, Figure is blockchain-based, so there's that. Congrats to Nima Wedlake for a portfolio win for Thomvest Ventures.

REAL ESTATE

THE OPENDOOR SAGA CONTINUES

By: Drew Meyers

Opendoor has a new CEO: Kaz Nejetian from Shopify. In that same announcement, they announced "Co-Founders Keith Rabois and Eric Wu are returning to the Board of Directors, with Rabois taking on the role of Chairman." Literally the same day, Eric Wu announced his new company ,Brain, along with a $30 million Series A. The move comes weeks after ❇️Carrie Wheeler stepped down❇️ (aka was ousted).

At the bottom of the press release, is Opendoor's one line description:

Opendoor is a leading e-commerce platform for residential real estate transactions whose mission is to power life’s progress, one move at a time.

Honestly, I don't what that means. Who is that written for? That sentence resembles a PR spinster's wordsmith exercise...selling some vague, but grand opportunity that you'd be stupid to ignore. In reality, it says nothing at all. For the 100th time, buying a house is not even remotely the same as buying a tchotchke on Shopify. When I hear e-commerce for real estate, Ownly comes to mind, as does Final Offer. Maybe that's the direction their M&A team will look.

Then there's the whole "cut 85% of the team" line of thinking from Rabois. Is a return of the founder DNA, cutting nearly the entire team, and reimagining everything with AI enough to turn the tables? It's not outside the realm of possibility. Yet, at the end of the day, ❇️I still don't understand how Opendoor is anything other than an undifferentiated seller lead generation portal❇️. And that ain't very interesting to any consumer.

PS #1: Heather Harmon (who sold RedDoor to Opendoor) calls this collection of developments "the Marvel reboot for iBuying." (her take is far more eloquent than mine).

PS #2: An Opendoor shareholder for a few years, I sold all my shares last week at around $5.50 per share, which finally put me back in the black for my overall investment. Now that shares are trading upwards of $9, I suppose I sold those shares a smidge too soon.

LEGAL MUMBO JUMBO

By: Drew Meyers

To "double down" on industry confrontations, Compass brought on a new chief legal officer, Ethan Glass, who "served as lead attorney for the National Association of Realtors throughout ❇️the Sitzer-Burnett trial❇️," according to Inman.

The take here is really damn simple. F*ck lawsuits as a strategy. Next.