A Waking of the iBuying Elephant

[Note from editor: We publish Bi-Weekly Transmissions for paying members of the GEM Crystal that consist of long form articles covering the spectrum from shipping container co-living spaces to the battle for listing acquisition in the first iBuyer world war. Below is a sample Transmission]

There were five. Now, we’ll have six.

Of course, we’re talking about public companies in residential real estate. Opendoor announced it will follow in Porch’s footsteps by merging with a SPAC for liquidity. The iBuyer is “merging with Social Capital Hedosophia Holdings Corp. II [in a] transaction giv[ing] Opendoor an enterprise value of $4.8 billion,” reports Inman News.

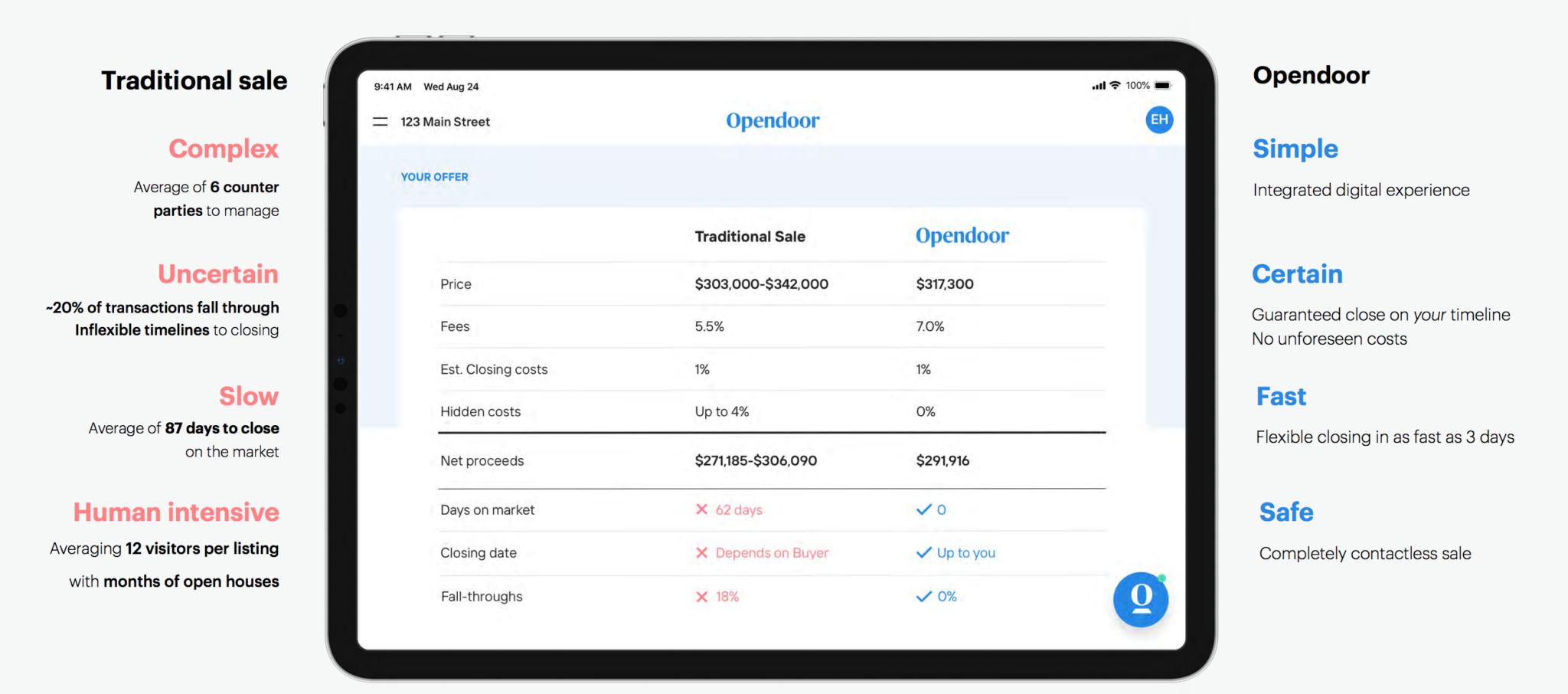

I have to say, its investor presentation is a thing of beauty. I recommend you review it in full here.

I have no doubts that a speedy, certain transaction is a superior buying and selling experience for customers. But, still, that doesn’t mean it makes sense for a company to deliver it to them.

In 2019, the company generated $4.7 billion in revenue selling 18,799 homes. Compare that to Zillow Group’s $1.365 billion in revenue in its homes division.

That’s a rosy, dominant picture indeed. Right up until you dig one level deeper, into actual profits, which are noticeably absent. Opendoor’s adjusted income for 2019 was a loss of $327 million. So, if it doubles revenue by 2023 to $10 billion, won’t that actually double losses too?

I know, I know, it’s a commonly held strategy: Go years without turning profit, then magically flip a switch and rake in the profits. If Amazon can do it, Opendoor can too right? The public markets are actually quite good at valuing companies, so that alternate version where profits are irrelevant is clearly driving the valuation.

Its arrival on the public markets will be a moment of reckoning that competitors will have to counter if they want to avoid Opendoor monopolizing real estate certainty. At the same time, a SPAC IPO will give Opendoor newfound cash and leverage to expand market share now rather than later.

CLEAR REASONING

In a CNBC interview, Opendoor co-founder and CEO Eric Wu mentioned that both speed to market and Chamath Palihapitiya are the two key reasons for bypassing a traditional IPO in favor of a SPAC.

The speed is obvious. After all, why spend months with the executive team focused on taking the company public when someone else can take that headache off your plate? It makes sense that an iBuyer–which provides certainty to its customers–would choose certainty over financial maximization. It would be hypocritical to do anything but.

And Chamath is, well, Chamath. While I don’t know the guy personally, he is one of the smartest people I’ve ever heard speak. It’s clear his intellectual IQ is way beyond the norm and his track record speaks for itself. Say all you want about SoftBank, but naysayers can no longer opine that nothing more than “dumb VC” money backs Opendoor. If I were Eric and the rest of the C-Suite, I’d sleep easy knowing I now have one of the smartest internet executives on the planet heavily vested in my success.

ONE-STOP

In his interview, Eric also mentions the mission to build a vertically-integrated digital one-stop-shop to buy and sell. We’ve heard that before, obviously. That’s the end goal the entire industry is working toward. Easier said than done, though.

Chamath paints a picture in this–let’s just call it what it is–infomercial for his rationale for investing. It includes a massive, fragmented sector worth $1.3 trillion annually.

Building software is one thing, but buying and selling physical homes is something else. It’s a service business dealing with the largest transaction of people’s lives. The thing is, is there any service business that’s NOT fragmented? Wealth management. Financial services. Dentistry. Even web design. The list goes on and on. Do we really want to “smash” the transaction down into an emotionless single-click? I still stand firmly behind the stance that there is merit to the existence of friction in the process.

WHERE TO GO FROM HERE

The question is not if the elephant has sourced energy from a new watering hole, it’s what the next steps a competitor left in the wake should take.

Potential chess moves:

Compass: Make two to three major brokerage acquisitions, and then line up a SPAC of its own. Despite the whole SoftBank debacle seemingly looking up, it isn’t out of the woods yet. Independents are coming for them, with Side among them. More money, better branding, and great salesmanship can only last so long before Compass loses its luster. Speaking of, what happened to Compass’ 20% market share in 20 markets by 2020 goal? I’d move fast and break things before there’s nothing left to break.

Redfin: I have to agree with Rob Hahn that a Redfin-Opendoor marriage would be very appealing (locked). The DNA of both companies are well aligned, and a merger makes sense for all the reasons Rivers Pearce mentioned when they originally joined forces. Redfin is a juggernaut on its own; a combination would be incredibly tough competition.

Offerpad: Band together with Zavvie, OfferBarn, W&R Studios, etc.–essentially, everyone but Opendoor and Zillow–with an industry-first stance. Partner with every brokerage you can. Perhaps even go so far as to take a BPP approach, and take investments to up their stakes in success. In fact, why not invite HomeSnap into the fold as well?

Zillow Group: The audience is there, by a landslide. And it has one other significant advantage in the form of “boots on the ground” in all markets via its business arrangements with ZPA’s. Its Flex program charges a referral fee to agents on closed transactions for Zillow-originated leads–one step away from being a full-scale brokerage. Yes, I’ll say it: The next move is becoming a brokerage (update: that happened) or, more accurately, a BaaS. Bite the bullet, go all in, and acquire Side to accelerate the effort.

After a slow several months on the industry front, thank you Opendoor (and Chamath) for infusing the “what’s next” conversation with new life. We’ll have one more company to add to our proptech earnings radar for Q4, assuming Opendoor hits its goal to be public by end of Q4.